Burberry's Checkmate. Battle Binkies. Algae Oil Has Arrived!

And has Magic Spoon lost its magic?

We get asked all the time, “How do you find the stuff you write about.” Short answer: brands are doing new things every day. Some of these things have deeper cultural, strategic and predictive meaning, and many do not. So we look for solid “why’s” behind the “what’s.” For us, it’s not about reporting on each and every happening— we don’t aim to be a current events pub. We’re here for brands and the people that build them. Our opinions, both sweet and snarky, exist to generate and shape brand growth ideas.

From London (Mia)

Luxury brands walk a fine line between visibility and exclusivity. Few stories illustrate this better than Burberry’s famed check— a pattern that has defined the brand’s British heritage for over a century. But as Burberry learned the hard way, even the most iconic branding can be diluted if it’s not carefully managed.

Originally introduced as a trench coat lining in the 1920s, the Burberry Check became a status symbol. But by the late 1990s, overexposure and widespread counterfeiting nearly destroyed its cachet, turning it into a cautionary tale of brand mismanagement. As a grunge-obsessed school kid during this time, nothing was considered more ‘chav’ than the Burberry check. (‘Chav’ was a popular 90s pejorative term that referred to my mortal enemies of the time–the sporty bullies who also wore Kappa trackies and listened to happy hardcore– but after reading Owen Jones’ brilliant book on the word’s classist origins, I don’t use it anymore).

After drifting far from its target consumer, Burberry decided to scale back, strip the pattern from much of its collection, and strategically rebuild its desirability. Fast-forward to today: the check is back. Under the creative direction of Daniel Lee, it’s been reimagined, modernised and carefully controlled— a great example of the power of brand discipline. The company now aggressively protects its pattern trademark, going after mass retailers and counterfeiters who try to capitalize on its recognition. The message is clear: Burberry owns this pattern. And it won’t let anyone devalue it. For marketers, Burberry’s playbook is a reminder that staying on brand requires actively managing it, constantly. Brand assets can lose their power if they’re overused, misapplied, or left unprotected. Consistency builds value. Control preserves it.

Fatso’s maximalist packaging, chunky bars and anti-‘posh choc’ positioning is fun and fresh. Product is 10/10, too.

50% of marketers haven’t yet incorporated AI into their work. For some, it’s uncertainty about where to start. For others, it’s concerns about whether AI can truly capture a brand’s essence. My answer to that is that it can– but only if you’re highly skilled at prompting. GenAI is only as good as the guidance it gets. As our friend and podcast guest, Sarah Ehlinger said recently about prompting: rubbish in, rubbish out. However, the right prompts and clear brand principles combined with human-driven strategic oversight can turn GenAI into a powerful tool for staying on brand—helping refine messaging, scale creativity and ensure every output reinforces what makes your brand distinct. The real risk isn’t AI. It’s falling behind while everyone else figures it out.

My friend in Montana sent me this snap of ridiculously cute (albeit wildly impractical) packaging for Hrum&Hrum walnuts. We LOVE receiving your intel on brands. Message us on Substack and we’ll pick our faves to feature in a future edition of On Brand!

From Chicago (Ellen)

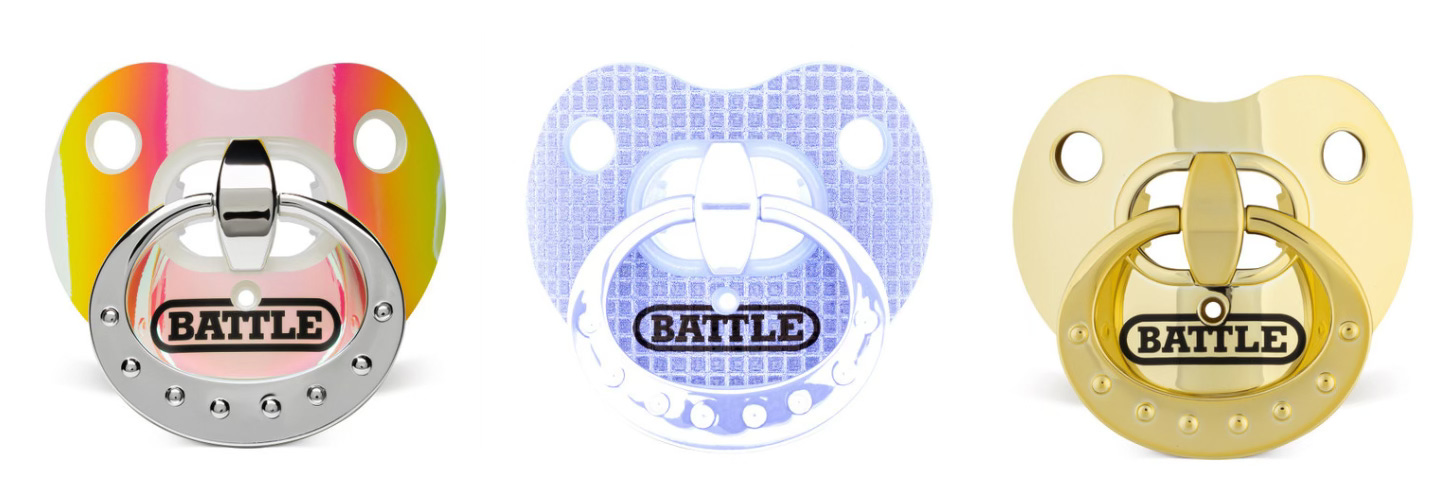

My latest Gen Z brand to watch: Battle. Simply put, they make football drip. Let’s face it, being in the drip department of any sport is a winning proposition these days— particularly if it penetrates youth culture. Remember ARiA? Still huge. Well, Battle has been around considerably longer than ARiA (since 2009), originally more serious and technical than its current go-to-market approach. But the brand is now at the convergence of some uniquely favorable market trends and bold marketing moves. Yes, the ongoing enhancement of safety measures in both professional and youth sports has been working in Battle’s favor for quite some time, but the brand’s real fuel lately seems to be the rise in women’s and girls’ flag football. More and more, fierce female plays are earning Battle attention on social media, with the spotlight often on the brand’s iconic “Binky” mouthguard. I know, it’s a strange product, but brilliant at the same time— super protective with a comfortable (some might say, familiar) fit and the perfect amount of weird, remarkable and bling to appeal to Gen Z.

‘Bling’ is a universal desire. I can’t knock Gen Z for their blinged-out sports binkies when my contemporaries are strutting around with oodles of purse and shoe charms strapped to their streetwear. Count on Anthro and its sister companies, Urban Outfitters and Free People, to appeal to our sparkle desires. Or is it about making a personal statement, possibly leaving behind a personal question? Bird charm: she must be a free spirit. Octopus charm: what’s that about? Is she clingy? We love to keep people guessing, don’t we?

I just scored my first bottle of algae oil in Chicago… must be legit. Anyone who follows health and wellness trends in America knows that they usually start on the coasts and then migrate inward. So, when Algae Cooking Club finally hit my local Chicago grocer earlier this year, I took it as a sign: algae oil is on its way to being upgraded from fad to forever solution. It’s worth noting that algae oil has had some starts and stops in the past. In the mid-2010s, Solazyme tried to get algae oil into the supply chain of several major food producers, touting its versatility, high smoke point and substitution for several preservatives. They hit too many roadblocks (Big Food is pretty set in its ways) and eventually sold their product and process to Corbion. Then Corbion re-launched algae oil for home use under the Thrive brand. They went with a heart health positioning using a lot of “Omega-this” and “mono-that” speak, got some decent distribution, but discontinued their product in 2020 because “they couldn’t make it a commercial success” (a.k.a. couldn’t capture the market).

Brilliantly, when Algae Cooking Club launched their version of algae oil in 2024, they focused on taste and culinary credibility. Ding, ding, ding, ding, ding! So far, this brand and product appear to be winning. Now, the only thing that seems to be working against algae oil’s success is the lack of testing to support its health and safety claims. I feel pretty confident that it’s better than many of the known “bad oils”, but is it in contention to replace canola and EVOO? Jury’s still out. The taste is pretty neutral so I’m using it a lot for roasting veggies. If scale continues to grow (and price comes down), then I think it finally has a shot of capturing some cooking share. But, Graza, you’ll always be my top choice for salads and dipping.

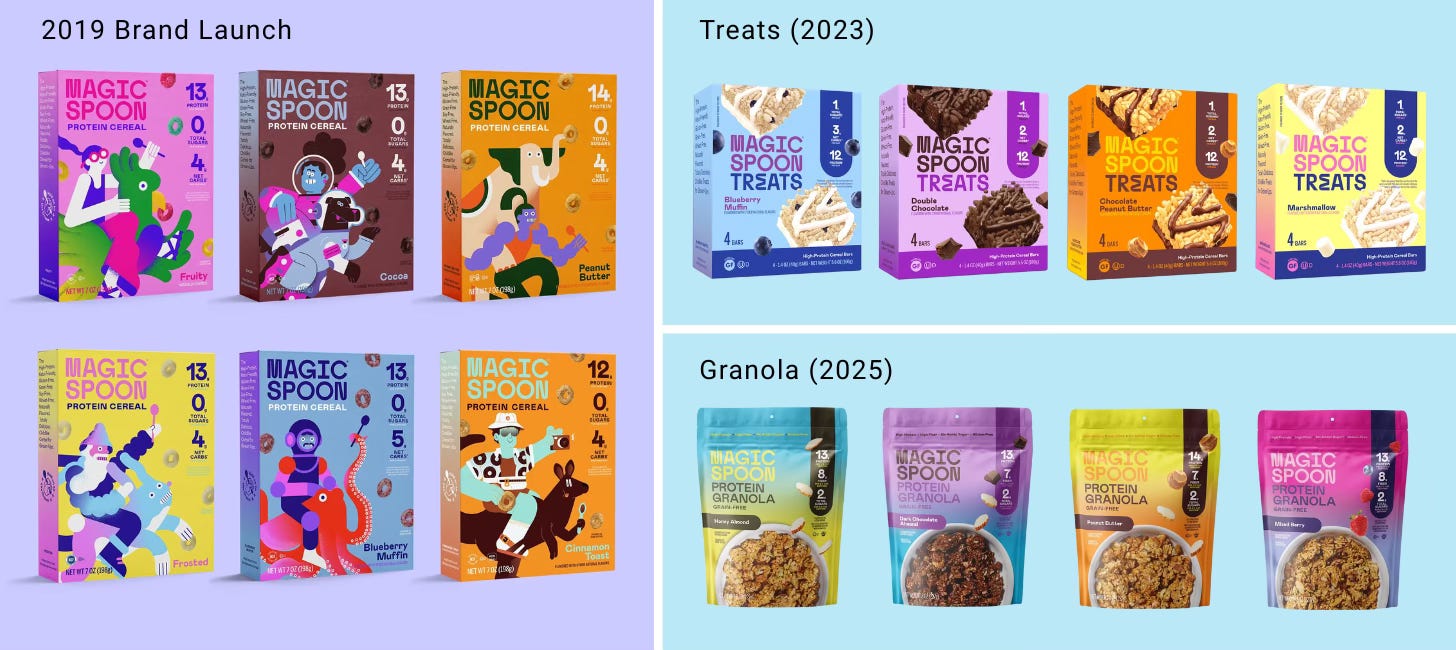

I’m afraid Magic Spoon has lost its magic. When the brand first hit cereal shelves in 2019 it was a big deal. The category was tired and struggling to make a comeback with many new health and diet-focused varieties. It was like a protein fortification buffet for crossfit types. Then along came Magic Spoon, no-grain and high-protein with nostalgic flavors, colorful packaging, modern cartoon graphics, and, quite literally, magical attraction (I’m not anti-grain, and I couldn’t resist trying it). They committed to the mystique of being both the antithesis of 1980s kid cereal and its modern likeness, made especially for adults. Then, in 2023, they launched cereal “Treats” claiming a thoughtful and on-brand approach. Fast Company reported,

“The brand extension graveyard is littered with companies that expanded into new territories too quickly, hoping to cash in on immediate popularity. Lewis and Sewitz (creators of Magic Spoon) used that reasoning to avoid going beyond cereal up to this point… and to inform why a treat bar was the next logical step.”

Apparently adults were hankering for a high-protein Rice Krispie Treats alternative as much as they were ungrained, nostalgic-tasting cereal. Really?!? Ok, I’ll bite. But what happened to the magic? MS’s Treats look a lot like Mid Day Squares, IQ Bar, Good & Gather, and many other supposed “better-for-you” bars. When the company launched granola earlier this year in an even more unmagical way, I couldn’t help but wonder, “Did they just forget ‘the brand extension graveyard is littered with companies that expanded into new territories too quickly, hoping to cash in on immediate popularity’ or simply no longer care?”

The evolution of the Magic Spoon brand, from magical category revivalist to ho-hum category copycat. In case you’re wondering, our links are never sponsored.

The Binky is such a great case study for sports marketing! Can’t go into a youth field these days without seeing the rings and blings!